REV up your success.

Get started with these helpful links.

Check out these important links to get started:

Sign up to access our partner app

Share your partner app

Join our Facebook group for tips, updates, and connecting with other REV members.

Justin Mandese - REAL Broker, LLC

Licensing Made Simple: What You Need to Know.

Here are some helpful links to get started

Click here to sign up for your NMLS#

Sign up for an approved NMLS course

Click here to take the SAFE Mortgage Loan Officer Test

Click here to learn how to share your Apply Now link with your clients.

What to expect

You must download our Partner App and verify your account in order to get started. Share your unique link with clients to submit your referrals. You and your clients will stay informed with alerts at every stage, from application completion to clear-to-close. Once the application is submitted, we’ll take it from there, ensuring a smooth process all the way through!

Getting started.

Filling out the app.

We need you to help the client start their application using your link. Just because you share the app link doesn't guarantee they will completed it. You'll be alerted once it's done; if not, it's a good idea to follow up and assist them with any questions. They can't "mess up" the application as we'll verify everything. The goal is to complete the application so we can jump in and get started.

The loan process.

Your role as a licensed Loan Originator starts with helping your client complete the loan application. This is the most important part—once the application is submitted, the Semper team takes it from there.

We’ll then guide your client through the next steps. They’ll be asked to upload a few documents (like pay stubs or bank statements) so we can verify everything needed for a solid pre-approval.

If they don’t upload right away, that’s okay. Our loan assistant will follow up with friendly reminders by email, text, and phone to make sure nothing gets missed.

Once we have all the documents, we’ll finish up the pre-approval and send it to both you and your client.

Point of contact

For questions about the REV program, reach out to your REV point of contact. For inquiries about a client, application, or status, please contact your assigned Loan Officer. If you need to escalate your question, contact your assigned Branch Manager.

Questions? Start Here.

You have the questions, we have the answers.

Can I enroll online?

Absolutely, and is our encouraged method of enrollment. Most questions can be answered in our FAQs, but just to make sure we touch all bases once enrolled you will have an opportunity to schedule a call with a member of our team. If you have questions to be answered before you enroll, schedule a call here.

Who is Semper Home Loans?

Since 2005, Semper Home Loans has been making homebuying easy with low rates and fast pre-approvals. Our streamlined process eliminates unnecessary steps, getting you pre-approved in as little as one hour. Your dedicated team will support you at every stage, answering all of your questions and making your homebuying experience enjoyable. We are proud to be licensed in over 40 states, bringing our expert services to homebuyers across the country.

How will I be paid?

REV partners have two options for receiving payment on closed referrals:

Option 1:

If you do not obtain your Loan Officer (LO) license, you are not eligible for client compensation or the REV(enue) downline. Instead, your buyer will receive a lender credit at closing. The process is simple, and we will provide you with the training and guidance needed to navigate the necessary steps.

Option 2 (Most Popular):

To double your source of income, you must become a Licensed Loan Officer. After passing the exam, you will be compensated by Semper Home Loans as a W2 employee, receiving a compensation of 75 basis points on all of your closed loans. You may also be eligible for a “sign-on” bonus3.

How does a lender credit work?

Lender Credit: The lender provides your buyer with a credit (known as a "lender credit") to help cover closing costs. For example, on a $500,000 loan, we would offer your buyer $2,500.

Using the Credit: This $2,500 credit can be applied towards closing costs, including fees or even the buyer's agent commission, so your buyer doesn't have to pay those expenses out of pocket.

What exactly is a basis point or bps?

Basis points, otherwise known as bps or "bips," represent one-hundredth of a percentage point on a loan. For example, take a $500,000 total loan amount multiply it by .0075 (75 basis points = 0.75%) and you get $3,750.00 just for sending Semper Home Loans your client.

Will I be a Loan Officer?

Yes, however, you won't be expected to take on the full responsibilities of a Loan Officer. You’ll continue to refer your clients as usual, acting as a Loan Originator. This approach ensures compliance with RESPA regulations while giving you the opportunity to build your downline and earn from refinances.

How am I paid on my REV(enue) downline?

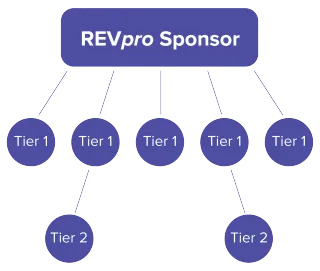

When a new agent joins REV and names the sponsoring REVpro agent as the person that referred them to the program, the REVpro agent becomes eligible for Tier 1 downline earnings. For example, if a sponsored agent closes on a $500,000 REV client the sponsoring agent will receive $1,875.00 ($500,000 multiplied by .375%). Once a REVpro partner has 5 agents in Tier 1 they become eligible to receive Tier 2 compensation. Tier 2 is anyone that has joined REV due to the efforts of a Tier 1 (now REVpro) partner. Tier 2 downline compensation is paid at 18.75 basis points, or on the $500,000 loan example the original sponsoring agent would make $937.50 ($500,000 multiplied by .1875%).

Will I receive Semper Home Loans marketing materials?

Once you join REV you will be invited to join our private REV Facebook Group. Shared in the group will be Loan Product Marketing Materials, Product Information, Best Tips from our Loan Officers, and how to grow wealth by getting licensed and REV(enue).

Will my pay show up on any closing disclosure?

Not at all, transactions will only show your real estate commissions.

Will my name be on the loan ?

Yes, you will be the Loan Officer but will also be assigned a Loan Officer to assist in getting the file to closing.

Will I know the status of my "loans" with you?

Yes, using your own co-branded application, you will be updated at every step, from application to closing. You will have real time updates on all of your files.

Is this Legal? Will I get "in trouble"?

YES its legal, and NO you wont get in trouble. The REV and REVpro programs have been purposefully designed to be RESPA compliant.

What if my client is from a different state that I am licensed in?

We are licensed in 40+ states. You will still earn your Real Estate commission but will not be compensated as a Loan Officer if you are not a licensed LO it that state.

What about refinances?

As a participant in our REVpro program, you will also receive compensation for refinance clients that close, regardless of location. This presents an excellent opportunity to reach out to your past clients who may be affected by higher rates. However, please note that participants in our REV program are not eligible to receive compensation for refinances as you are not a licensed Loan Officer.

If I move real estate brokerages, what happens?

Nothing on our end, it does NOT matter to us what brokerage you work with. Wherever you are happy, we are happy that you are there.

REVolutionize your career

1 In order to be compensated when your purchase or refinance clients close, you must be licensed as a Loan Officer with Semper Home Loans. Compensation for your clients’ closed loans is only available to those who hold a valid Loan Officer license with Semper Home Loans. To be eligible for compensation, you must meet all licensing requirements, including obtaining an NMLS number, completing the 20-hour pre-licensing course, passing the SAFE Mortgage Loan Officer Test, and a W2 employee with Semper Home Loans. Individuals enrolled in the Semper REVpro program and licensed as a Loan Officer with Semper Home Loans are W2 employees and will receive 75 basis points on all client loans that are successfully closed. To be eligible for this compensation, the client must have been brought in by the licensed Loan Officer and the loan must have successfully closed. The only requirement for the loan is to initiate the application; our support staff will process the file through closing. Compensation is limited to 75 basis points, and no additional fees or compensation will be provided for other activities related to the loan.

2 By signing up for REV, you are eligible to charge the buyer a legitimate “buyer’s agent fee” (documented on the LE and CD) which is offset to the buyer via Semper’s standard Lender Credit.”). Please note that you will not be compensated for any of your clients' closed loans unless you are enrolled in our REVpro program, a licensed Loan Officer with Semper Home Loans and a W2 employee. Compensation is only available to those who meet these program, licensing and employment requirements.

3 The sign-on bonus is issued on a case-by-case basis, and amounts may vary depending on individual circumstances and production levels. The company reserves the right to modify, suspend, or terminate the sign-on bonus program, including its eligibility criteria and performance targets, at any time and without prior notice. All bonuses are subject to the terms and conditions set by the company.

© Copyright 2025. Semper Home Loans. All rights reserved.

It's time double your income with Semper REV

© 2010-2025 Semper Home Loans Inc. NMLS #1053 www.nmlsconsumeraccess.org

Semper Home Loans, Inc. is an Equal Opportunity Employer. Semper Home Loans, Inc. does not discriminate on the basis of race, religion, color, sex, gender identity, sexual orientation, age, non-disqualifying physical or mental disability, national origin, veteran status or any other basis covered by appropriate law.

Semper Home Loans, Inc. is an Equal Housing Lender. We do business in Accordance with Federal Fair Lending Laws. Under the Federal Fair Housing Act, it is illegal, on the basis of race, color, national origin, religion, sex, handicap or familial status (having children under the age of 18) to: Deny a loan for the purpose of purchasing, constructing, improving, repairing, or maintaining a dwelling or to deny any loan secured by a dwelling; or Discriminate in fixing the amount, interest rate, duration, application procedures, or other terms or conditions of such a loan, or in appraising property.

All employment is decided on the basis of qualifications, merit, and business need. Licensed in the following states: AL, AZ, CA, CO, CT, DE, DC, FL, GA, IL, IN, IA, KS, LA, ME, MD, MA, MI, MT, NE, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WY